|

Help is on the way – tax software for 2008.

by Betty Harris Montgomery

Preface.

One huge admonition for these software programs. About mid-February update your program. By then, most changes should have been made and your program will be current. The IRS won’t accept “defective” software as a defense. Please update.

Enjoy your refund.

Charles W. Evans, Reviews Editor

TaxACT Ultimate Bundle TY2008

Tax payers, relax. TaxACT can ease your filing anxieties. This software, by 2nd Story Software, includes two products, at an extremely reasonable price and it can transfer 1040 data into the state forms and import 2006 data from prior TaxACT years. Tax payers, relax. TaxACT can ease your filing anxieties. This software, by 2nd Story Software, includes two products, at an extremely reasonable price and it can transfer 1040 data into the state forms and import 2006 data from prior TaxACT years.

This is an important program that can cover most individual or small business tax needs. It is through and basic and not as comprehensive as TurboTax or TaxCut, but for most people, it is quite adequate.

This is where TaxAct really shines, because not only is their interview process simple and straight-forward, but the help and explanations are with you on every screen. Along with the Form Instructions button, which displays W-2 form help if you’re filling out your W-2, 1099 help to fill out your 1099, etc.

Creating your on-line account is a cinch: Create your user name, etc., provide your e-mail address and you’re done!

Packed with features to make taxes fast and convenient:

- eFile your federal return - FREE! Certain income limit. (Fast refund direct to your bank account. Up to four additional returns e-filed for $7.95 each.)

- Prepare and print as many returns as you wish-FREE! You can prepare returns for yourself, parents, children, and more at no additional cost.

- Alerts help you steer clear of problems. TaxACT will inspect your return and alerts you to errors, omissions, etc.

- TaxACT addresses the tax needs of investors. Import capital gains transactions from GainsKeeper. Keeping track of your mutual fund, stock, and options.

Some additional considerations…

- Password Protection. Keep your data safe from others who may have access to your computer.

- Online Help is only a click away!

- Expert Tax Help featuring J.K. Lasser's Your Income Tax 2008. You have a specific tax issue, need help with a form, or are in need of tax saving ideas; you'll get the answers quickly.

- Informative Life Events advice. Determine how to handle major Life Events such as getting married, more kids, home sales, etc.

Not all versions have the JK Lasser's Your Income Tax resource. It is an exceptional resource for your taxes.

2nd Story Software provides tax help by phone at no additional charge to users of the higher end versions. By contrast, TurboTax is using a live community to answer tax and software questions. Users of TaxCut Premium get one session with an H&R Block advisor by phone.

The standard version of TaxACT contains the federal tax modules. The Deluxe version adds context-sensitive tax tips from JK Lasser, advice for life changes, free technical support by phone, and FAFSA worksheets. The Ultimate version is the same as the Deluxe version, but adds one state tax module. Additonal e-filings are under $10. Or you can download the program again under $10, clearly the budget deal.

You have the option of opening J.K.Lasser's tax adviser at the bottom of the screen for reference. No automatic importing from Money or Quicken to lighten your load.

TaxACT’s interface is considerably less sophisticated and more tedious than its higher priced competitors. Only one interview question is presented per page, so it can be extremely arduous to click back through to a specific form. The font is very small. Interview questions are filled with tax jargon that the average filer might not always understand.

There’s no denying that TaxAct is a great value for the money, especially if you are either a 1040EZ filer or someone who is mostly familiar with the tax system and just wants a quick way to e-file. If you aren’t put off by the bare-bones interface you can save a surprising amount of cash on software, even if it might not save you as much on your deductions.

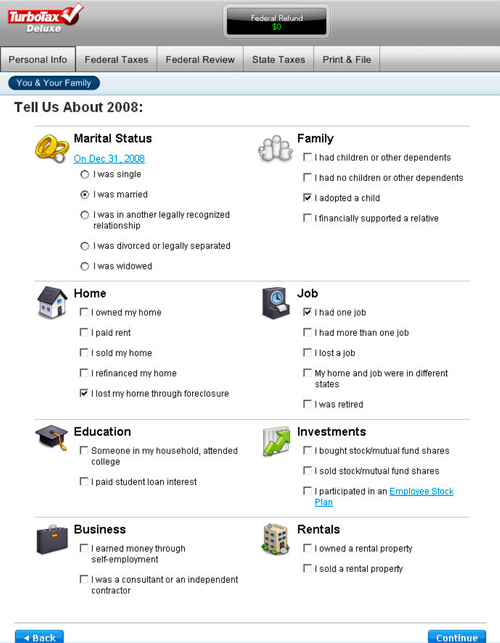

TurboTax Premier for TY08

TurboTax is a winning combination of simple navigation, an extensive help library, a responsive online community full of knowledgeable users and overall ease of use. The navigation is the easiest to follow, even for novice. One of the features I especially liked is that it groups related items together and asks you to check the ones that apply to you. It saves you time from answering "no" question after question. TurboTax is a winning combination of simple navigation, an extensive help library, a responsive online community full of knowledgeable users and overall ease of use. The navigation is the easiest to follow, even for novice. One of the features I especially liked is that it groups related items together and asks you to check the ones that apply to you. It saves you time from answering "no" question after question.

TurboTax has kept their software intuitive and explanations simple. It follows a linear process so all you need to do is answer the questions in front of you and if you don't know what answer to give, check the extensive Help section.

TurboTax Deluxe offers every feature we looked for and includes some excellent options.

- Direct Deposit of Refunds

- Quick Entry for Investments

- Deductions/Credits Guided Interviews

- Error Checks

- Medical Expenses

- Electronic Filing with Confirmation of Receipt

It can evaluate your 401K contributions and estimate how much you can contribute before it affects your take-home pay.

New for 2008 returns:

Deduction Maximizer Center:Shows you how to qualifyfor just about any deduction — so there are no lost opportunities. Looks for deduction opportunities as you go — shows you which deductions you've taken, which you haven't, and which you're not yet eligible to take. And helps find overlooked deductions — reviews your return to identify missing income information and missed deductions.

Life Events Planner:Guides you through common life events - new home purchases, new dependents, etc.

Audit Alerts— Flags items the IRS might question — before you file.

You can finish a tax return with TurboTax quickly if you have a simple, straightforward tax return. This makes even the basic edition of TurboTax a great deal. TurboTax caught an entry typo on a W-2 form. I was quickly prompted me to verify my numbers correctness.

Intuit includes the ItsDeductible software for calculating the fair market value of items donated to charity in Deluxe and higher versions of TurboTax. Premier and Home & Business versions feature the Basis Pro service for extra help in calculating your cost basis in stocks and mutual funds.

Turbo Tax generally is great for those with a more in depth financial situation. It is easy to use and extremely thorough in its interviews.

If you use Quicken for your weekly finances, much of your data can be imported into Turbo Tax. However as the Quicken categories may differ, you will need to review your return carefully.

You may want to try Intuit's Snap Tax. It is free for the filing, under $10 to e-file, and provides basic help for each tax form line and the math behind them. To avoid any costs but the postage, just print out your final forms and mail it in yourself.

If you had significant or complicated capital gains or losses Turbo Tax Premium handles Schedule D with thoroughness necessary for wading through the applicable tax implications. Turbo Tax will even calculate the cost basis for stocks that have split.

Is it the best bet for you? If your return is complicated, most experts say yes. But is your return complicated? Here are a few questions that indicate a more complicated tax return and might help you decide which package is for you.

- Do you have any deductions that include mileage or even mileage divided into different types, say some for your work, some for charities and trips to the doctor?

- Sales of assets, or any difficulty arising from stocks and dividends?

- Significant charitable contributions? CARE, Goodwill, Salvation Army, United Fund, etc.

Support is available through an extensive FAQ, well-populated and active forums, a blog, an (almost useless) automated chat system, and a support line. Technical support by phone as well as professional tax advice are offered 7 days a week fro 8am-5pm. Unfortunately the latter will cost you $29.95 per phone or email conversation. A professional audit defense will cost you $34.95, which is free to HR Block’s TaxCut suite.

Feature-wise, TurboTax is the undisputed king of tax suites, and its deduction manager is peerless among its competitors. It is also one of the most expensive suites, especially considering the extra charges for audit defense and tax advice. If you plan on using either heavily, should consider TaxCut Signature, which offers both services for about $28 (with 15% coupon here) more than TurboTax Premier. In any other situation, it’s hard to go wrong with TurboTax.

TaxCut for TY2008 by H&R Block

This product includes the necessary tools for the average homeowner, the taxpayer with investments, and those looking to itemize their returns. Included are H&R Block’s tried-and-true Worry-Free Audit Support, and one session of Ask a Tax Advisor, where you can speak directly with an H&R Block tax pro via phone or email. TaxCut offers almost everything TurboTax offers except year-to-year deduction comparisons. This product includes the necessary tools for the average homeowner, the taxpayer with investments, and those looking to itemize their returns. Included are H&R Block’s tried-and-true Worry-Free Audit Support, and one session of Ask a Tax Advisor, where you can speak directly with an H&R Block tax pro via phone or email. TaxCut offers almost everything TurboTax offers except year-to-year deduction comparisons.

TaxCut boasts a simple but effective interface allowing for easy navigation forward and backwards. Navigating your way back to where you need to be is a snap. The tax interview process is straight-forward, but sometimes presents questions and explanations that may seem cryptic to the average taxpayer.

One of the strengths of TaxCut is that you don't need to have accounting experience of any kind. Simply answer the questions the program asks you. TaxCut automatically checks your return for common errors. It provides an extensive explanation of tax regulations and helps you make the most of your tax return.

TaxCut has added Worry-Free Audit Support through H&R Block, so if you get audited, an H&R Block representative will guide you through your dealings with the IRS, and even represent you, the taxpayer.

Multimedia help is available to explain recent tax law changes and tax term definitions. Also included is a free one-time consultation with an H&R Block tax professional, a helpful resource for those one or two pressing questions.

If the IRS sends an audit notice…

- H&R Block will provide you assistance with the notice and/or offer to provide you with an H&R Block Enrolled Agent to represent you if you are audited.

- Call 1-800-HRBLOCK to initiate audit services that you may need. Conditions apply. View the complete terms and conditions for details.

TaxCut's clean interface and short interview questions all helped speed things along. Imports data from personal finance software, such as Quicken and Microsoft Money. TaxCut provides tax planning calculators for estimated taxes and retirement savings.

Block also offers a Home & Business edition that includes TaxCut Premium plus software to prepare a business tax return and payroll returns. TaxCut Home & Business is vastly more comprehensive of a software bundle than the similarly named TurboTax Home & Business.

TaxCut (Standard, Deluxe and Premium Editions) comes in a close second to TurboTax and may offer you the best package for your needs. It walks you through a thorough interview process to get all the necessary data. Unfortunately some of that information needs to be re-entered again.

TaxCut partners with DeductionPro, a tax deduction add-on can handle medical and other deductions on Schedule A. TaxCut can also import W-2s as well as Schedule D, but from a more limited list of sources. If you would like to use this perk, check and make sure your data sources are supported.

With Block's rich history of tax preparation, it is tops for tax explanations and guidance as you fill in the interview. TaxCut has some great tax update information available and it's coherently explained. Some nice touches are its listing of expense categories that you check...then only in those categories is information requested. Schedule A begins with a listing of basic sections which you check if relevant. However, it is not as thorough as TurboTax in covering expense descriptions. Schedule C and D are handled competently.

Prepare yourself for some eyestrain if you plan to spend more than a couple of hours in front of this product. On the help front, TaxCut is strong. It basically amounts to asking jargon-filled interview question by default, but placing a “guide me” button that will rephrase technical questions into a series of simplified ones.

TaxCut’s main strength is the included advice from H&R Block tax professionals. TaxCut also includes audit defense at no extra charge in both packages, up to a point.

Betty Harris Montgomery is a HAL-PC family member and retired tax preparer. “I no longer prepare taxes, but I think you will gain a much better understanding of your finances by doing so.”

|